Employee Benefits in Germany 2025: Eligibility, Legal Framework & Key Perks

Updated On

-

Copy link

-

-

In 2025, employee benefits in Germany include statutory pension insurance, occupational pension schemes, and paid parental leave. Workers also enjoy generous vacation entitlements and flexible working arrangements.

Limited-time offer : Access a free 10-Day IELTS study plan curated for you

Table of Contents

- Who is Entitled to Employee Benefits in Germany?��

- Legal Framework and Regulations for Employee Benefits in Germany

- Common Employee Benefits in Germany

- Parental Leave Benefits in Germany

- Statutory Pension Insurance (DRV)��

- Unique German Benefits (2025)��

- Understanding Employee Benefits for Foreign Workers in Germany

- Thinking of Moving Abroad? Here's How We Can Help

- Frequently Asked Questions

Employee benefits refer to the additional perks and advantages that employers provide to their employees in addition to their regular salary. Employees in Germany are entitled to a wide range of benefits that aim to enhance their well-being and provide them with financial security.

Let’s delve into some of the benefits available to employees in Germany.

Who is Entitled to Employee Benefits in Germany?��

Full-Time Employees

Full time employees in Germany typically work for four days a week and 30 hours per week. They are entitled to statutory employee benefits, which generally starts after completing four weeks of continuous employment.����

Part-Time and Temporary Employees

Part time and temporary workers can also avail statutory benefits. These benefits are pro-rated based on the number of hours worked. For instance, vacation days and paid leave are calculated according to their actual working hours compared to a full-time schedule.��

Apprentices/Trainers

Apprentices and trainers are made to statutory benefits, though the extent of additional fringe benefits may depend on the employer’s policies and any collective agreements in place.����

Legal Framework and Regulations for Employee Benefits in Germany

The legal framework for employee benefits in Germany is primarily governed by the Social Security Code (Sozialgesetzbuch or SGB), which encompasses regulations related to retirement, health, disability, and accident benefits. Additionally, there are specific laws and regulations related to individual employee benefits, such as parental leave and vacation entitlements.

Common Employee Benefits in Germany

Work Hours and Overtime

Work hours and overtime regulations in Germany are governed by the Working Time Act (Arbeitszeitgesetz or ArbZG), which sets limits on the maximum number of hours employees can work per week and per day.

1 Maximum Work Hours - According to ArbZG, employees are generally not allowed to work more than 48 hours per week, including overtime. There are exceptions for certain industries and professions.

2 Overtime Compensation - Employees who work more than their regular work hours are entitled to overtime compensation, which can be in the form of additional pay or compensatory time off.

Employee Representation

Employee representation is an important aspect of German labor law, and employees have the right to form works councils (Betriebsrat) to represent their interests in the workplace.

1 Works Councils - They are elected by employees and have the right to participate in decisions that affect employees' working conditions, such as working hours, remuneration, and health and safety measures.

2 Collective Bargaining Agreements - Many employees in Germany are covered by collective bargaining agreements negotiated between employers and labor unions, which provide additional rights and benefits beyond the minimum requirements of labor law.

Vacation Entitlements for Employees in Germany

Vacation entitlements in Germany are regulated by the Federal Vacation Act (Bundesurlaubsgesetz or BUrlG), which stipulates the minimum number of vacation days that employees are entitled to based on their length of employment.

1 Minimum Vacation Entitlements - According to BUrlG, employees are entitled to a minimum of 20 vacation days per year for employees working a five-day week, with additional vacation days based on the length of employment.

2 Collective Bargaining Agreements - Many employees in Germany are covered by collective bargaining agreements that provide additional vacation entitlements beyond the minimum requirements of BUrlG.

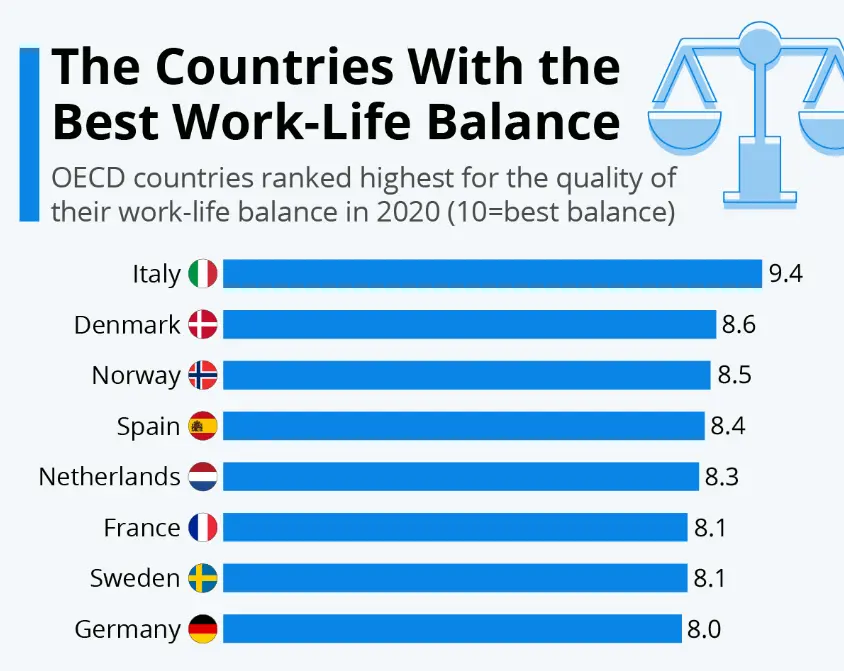

Source: Statista

��

Parental Leave Benefits in Germany

Maternity Protection

-

Duration: Female employees qualify for maternity protection leave for 14 weeks—6 weeks before the expected due date and 8 weeks after the birth of the child (extended to 12 weeks in cases of premature or multiple births).

-

Pay: During this period, employees receive full maternity pay, which is covered by the statutory health insurance fund and topped up by the employer to match the employee’s average net earnings.��

Parental Leave (Elternzeit)

-

Who is Eligible: Both mothers and fathers qualify for parental leave.

-

Duration: Up to 3 years per parent, per child. Parental leave is job-protected and can be taken by either parent or split between both. Parents can take parental leave together or separately, and part of it can be postponed until the child turns 8 years old.

-

Pay: Parental leave itself is unpaid, but parents may be eligible for Parental Allowance (Elterngeld).

Parental Allowance (Elterngeld)

-

Duration: Paid for up to 12 months for one parent, or up to 14 months if both parents share the leave (minimum 2 months per parent).

-

Amount: Typically 65%–67% of the parent’s average net monthly income before the child’s birth, with a minimum and maximum cap.

-

Flexibility: Parents can choose between standard Elterngeld (12–14 months) or ElterngeldPlus, which allows payments to be spread over a longer period at a reduced rate.������

Statutory Pension Insurance (DRV)��

-

Coverage:��Most employees in Germany are covered by statutory pension insurance, including those subject to social security contributions and many self-employed individuals.

-

Contribution Rates:��The contribution rate for statutory pension insurance remains at 18.6% of gross income, split equally between employer and employee.

-

Contribution Ceiling:��As of 2025, the maximum monthly income used to calculate pension contributions is €8,050, with a nationwide ceiling now unified across Germany (removing the previous East/West distinction).

-

Benefits:��DRV provides old-age pensions, disability pensions, and survivor pensions. The pension amount depends on average income during working years, the number of contribution years, and retirement age.����

Statutory Pension Insurance in Germany

Statutory pension insurance, also known as the Deutsche Rentenversicherung (DRV), is a mandatory social insurance program that provides retirement benefits to eligible employees. Contributions to the DRV are shared between employees and employers and are based on income. The benefits provided by the DRV are based on a formula that takes into account the average income during the working years, the number of contribution years, and the retirement age.

- Eligibility and Coverage: Most employees in Germany are covered by statutory pension insurance, including employees who are subject to social security contributions and self-employed individuals.

- Contribution Rates and Benefits: The contribution rates for the DRV are set annually and are shared between employees and employers. The benefits provided by the DRV include old-age pensions, disability pensions, and survivor pensions.

- Retirement Age and Pension Calculation: The standard retirement age for the DRV is gradually increasing from 67 years to 67 years and 3 months, depending on the birth year. The amount of pension benefits is calculated based on the average income during the contribution years and the number of contribution years.

Source: Statista

Occupational Pension Schemes in Germany

Occupational pension schemes in Germany, also known as Betriebliche Altersvorsorge (bAV), are additional retirement benefits provided by employers voluntarily.

- Company Pension Plans are established by employers and can take various forms, such as direct commitments, pension funds, and Pensionskassen. These plans are funded by employer contributions and, in some cases, employee contributions.

- Direct Insurance: Direct insurance is a type of company pension plan where the employer purchased insurance policies on behalf of employees, and the premiums are paid by the employer.

- Pension Funds: Pension funds are established by employers or industry associations to provide retirement benefits to employees. These funds are managed by professional fund managers and invest in a diversified portfolio of assets.

- Additional Voluntary Contributions: In addition to employer-funded contributions, employees can also make voluntary contributions to their occupational pension schemes to increase their retirement benefits.

Other Employee Benefits in Germany

- Employee Assistance Programs (EAPs) provide employees with access to confidential counseling and support services for various personal and work-related issues, such as mental health, financial concerns, and work-life balance.

- Training and Development Opportunities - Many employers in Germany offer training and development opportunities as a fringe benefit, providing employees with opportunities to enhance their skills and knowledge through workshops, seminars, or certifications. This can contribute to their career growth and professional development.

- Flexible Working Arrangements such as remote work options, flexible hours, and compressed workweeks, are also common in Germany. These arrangements provide employees with greater flexibility in managing their work and personal responsibilities, leading to improved work-life balance.

Unique German Benefits (2025)��

13th Month Salary

-

Many employees in Germany receive a 13th month’s salary, which is commonly paid at the end of the year of bonus. This is especially important in sectors covered by collective agreements, such as the public sector, where the 13th month’s salary is being further increased as part of recent wage settlements.��

-

Though not mandated by law, this bonus is a practice that is�� referred to as “Christmas money” (Weihnachtsgeld).��

Kurzarbeit (Short-Time Work Allowance)

-

The Kurzabeit scheme allows employers to reduce employers’ working hours during economic downturns, with the government subsidizing lost wages.��

-

Kurzabeit came to rise during the COVID-19 pandemic and remains a key feature of the German labor market for managing economic fluctuations.��

Understanding Employee Benefits for Foreign Workers in Germany

Foreign workers in Germany are entitled to the same employee benefits as German workers, including health insurance, paid vacation, sick leave, maternity and paternity leave, pension plans, and unemployment benefits if they meet certain requirements. Overall, Germany offers comprehensive employee benefits to both its native and foreign workers, which help to ensure their well-being and financial security.

So, maximize your job search in Germany with ����ÿ�մ��� (Global Immigration Services), and don't miss out on the chance of unlocking a world of employment benefits in Germany.

Before that, learn what facilities ����ÿ�մ��� offers.

Thinking of Moving Abroad? Here's How We Can Help

- Point calculation: In ����ÿ�մ���, we calculate your points on your behalf to eliminate any chances of rejection or failure.

- Visa application: ����ÿ�մ��� helps you to complete your visa application properly and we even train you for your visa interview process, to make your immigration journey easier.

- Preparation for Language Test: ����ÿ�մ��� offers you expert guidance for your preparation for language tests like IELTS/PTE/CELPIP.

- Expert guidance for each step of your immigration: With ����ÿ�մ���, you rest assured about your immigration journey. We help you to take every step in the right direction to make your immigration journey smooth.

- Job Search assistance: At ����ÿ�մ���, you receive complete job search assistance, from CV optimization, to mock interviews everything is covered by ����ÿ�մ���. And we won’t leave you alone until you get your job in your dream country.

So, don’t waste your time thinking about the best time to visit Germany. Start your career in Germany with ����ÿ�մ��� by

Frequently Asked Questions

Q1. Are fringe benefits mandatory for employers in Germany?

In Germany, certain fringe benefits such as health insurance, retirement benefits, and paid time off are mandatory for employers to provide to their employees. However, other fringe benefits such as company cars, employee assistance programs, and flexible working arrangements are not mandatory.

Q2. Can employers provide additional benefits beyond the statutory requirements in Germany?

Yes, employers in Germany are allowed to provide additional benefits to their employees beyond the statutory requirements. These additional benefits can be customized according to the employer's policies and may include different perks.

Q3. Are there any legal requirements for providing fringe benefits in Germany?

Yes, employers in Germany must comply with various legal requirements when providing fringe benefits to their employees. This includes adhering to labor laws, tax laws, social security regulations, and other relevant legal provisions. Failure to comply with these legal requirements can result in penalties and legal consequences.

Q4. Can employees choose to opt out of certain fringe benefits in Germany?

In general, employees in Germany are entitled to receive mandatory fringe benefits, such as health insurance and retirement benefits, and cannot opt out of them. However, employees may have the option to decline or choose alternative benefits, depending on the employer's policies.

Q5. Can employers change or revoke employee benefits in Germany?

Any changes or revocation of fringe benefits in Germany must comply with the employer's policies, employment contracts, and applicable legal requirements. Employers cannot unilaterally change or revoke benefits without proper notice and agreement with the employees, and any changes must be communicated transparently and in compliance with legal provisions.

Useful links: Further Reading and Information

Limited-time offer : Access a free 10-Day IELTS study plan curated for you